Categories: Insolvency,News

The UK catering and hospitality industry continues to face significant financial pressures, with 3,464 businesses...

Categories: News

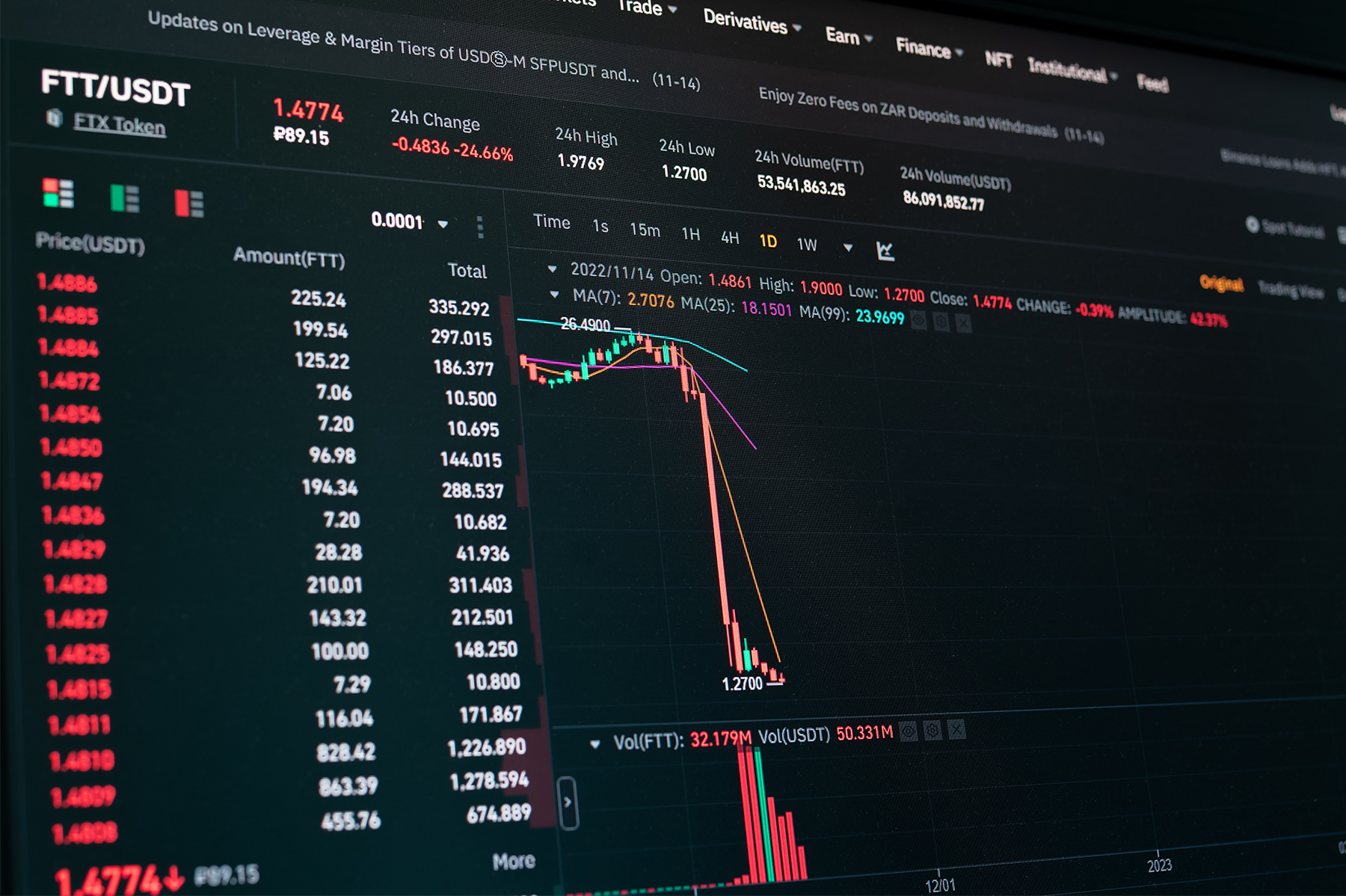

The collapse of the FTX cryptocurrency exchange in 2022 left many customers reeling from substantial...

Categories: News

In April 2024, Taylor Wessing, a leading international law firm, published an insightful article shedding...

Categories: News

Dion Perry Mailich, a Borehamwood accountant, has been banned from running a company for 12 years and ordered...

Categories: News

In a recent turn of events, the collapse of The Body Shop has raised concerns about the...

Categories: News

In yet another blow to the high street, fashion giant Ted Baker has succumbed to...

Categories: News

[vc_row][vc_column][vc_column_text] Preferences in Insolvency When a company goes into an insolvency process of administration...

Categories: News

The news we all knew was coming, but most feared, was confirmed yesterday when for...

Categories: News

DCA Business Recovery have now moved offices and are now located at 18 Clarence Road,...

There’s an air of uncertainty as Thursday looms closer and spending any length of...