Categories: Insolvency,News

The UK catering and hospitality industry continues to face significant financial pressures, with 3,464 businesses...

Categories: Articles

We wanted to bring to your attention a unique opportunity for your clients considering a...

Categories: Articles

At DCA Business Recovery, we are always committed to supporting meaningful causes, and this past...

Categories: Articles

For business owners considering winding down their companies, the Members Voluntary Liquidation (MVL) process presents...

Categories: Articles

Navigating the financial landscape of a company can be complex, especially during times of financial...

Categories: Articles

Navigating the complexities of liquidation can be daunting for both employees and company directors. When...

Categories: Articles

A disclaimer in liquidation is a powerful tool available to liquidators dealing with burdensome property...

Categories: News

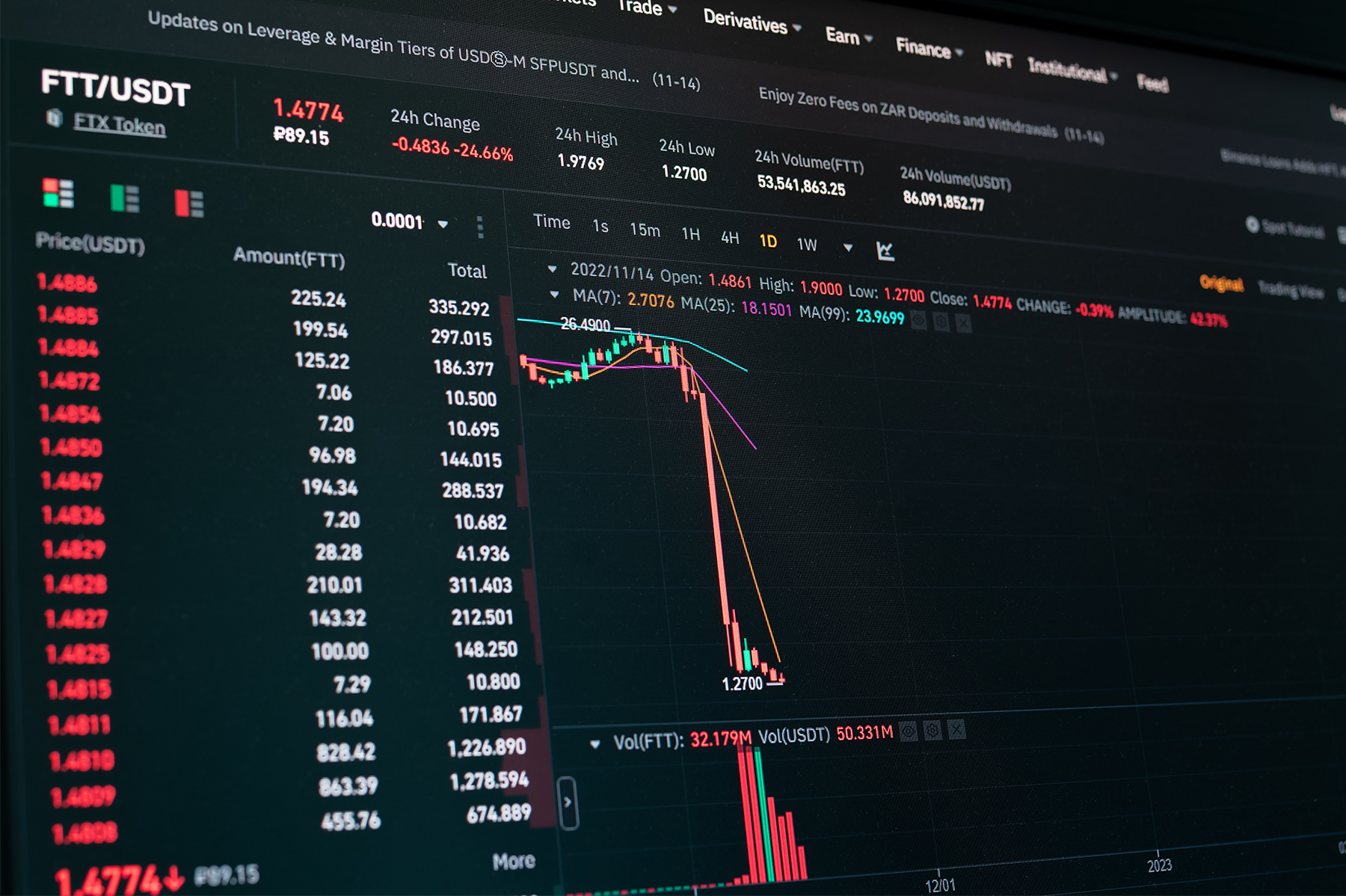

The collapse of the FTX cryptocurrency exchange in 2022 left many customers reeling from substantial...

Categories: Articles

Boris Becker, the illustrious six-time Grand Slam champion, has emerged from the shadow of bankruptcy...

Categories: News

In April 2024, Taylor Wessing, a leading international law firm, published an insightful article shedding...